Merchant Cash Advances

Can provide small businesses with quick access to capital, but they typically come with high interest rates and fees. It's important for businesses to carefully consider the terms and conditions of a merchant cash advance before applying for one, and to explore all other financing options available to them.

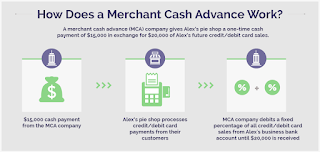

Merchant cash advances (MCAs) are a type of funding that small businesses can use to access working capital quickly. Instead of repaying a loan with fixed payments over a set period of time, businesses using an MCA pay back the advance with a percentage of their daily credit card sales. This can be a flexible option for businesses that have a high volume of credit card sales and need funding quickly. However, MCAs typically have higher interest rates and fees than traditional loans and it's important for small businesses to carefully consider the terms and conditions of an MCA before applying for one. It's also important for small business owners to shop around and explore other financing options, such as business loans, lines of credit, or crowdfunding.

Many types of businesses can qualify for a merchant cash advance (MCA), including retailers, restaurants, service providers, and e-commerce businesses. The qualifications for an MCA typically include having a certain amount of credit card sales and being in business for a certain period of time. In general, businesses that have a high volume of credit card sales and are able to demonstrate a consistent cash flow are more likely to qualify for an MCA. However, it's important to keep in mind that the qualifications and requirements can vary depending on the lender, so it's always best to check with the lender directly to see if your business would qualify. Additionally, merchant cash advance providers typically have more flexible requirements than traditional lenders, so businesses with lower credit scores may still qualify.

If you are interested in applying for a merchant cash advance (MCA), there are a few steps you can take to get started.

Research different MCA providers: Look for providers that have experience working with businesses in your industry and compare their terms, fees, and interest rates.

Gather your financial documents: You will need to provide financial information such as bank statements, tax returns, and credit card processing statements to the lender.

Apply online or in person: Many MCA providers have online applications, while others require you to apply in person.

Review the offer: Once the lender approves your application, they will provide you with an offer. Carefully review the terms and conditions of the offer, including the repayment schedule, interest rate, and fees.

Sign the contract: If you agree with the terms and conditions, sign the contract and provide any additional documentation requested by the lender.

It's important to shop around and compare offers from different MCA providers to ensure you are getting the best terms and rates. Also, it is highly recommended to consult with a financial advisor or accountant before applying for a merchant cash advance as it's a high-cost option and it could be detrimental to your business if not handled properly.

Merchant Cash Advance | Business Financing | Business Capital Companies

No comments:

Post a Comment